In the present monetary climate, understanding Interest Rates— especially the 30-year fixed contract rate — is essential for anybody hoping to buy a home or renegotiate a current home loan. This exhaustive aide will investigate current financing costs, patterns, and correlations, zeroing in on the US while additionally tending to related points like car advances, worldwide rates, and helpful devices like loan fee mini-computers and diagrams.

Understanding Interest Rates

What Are Interest Rates?

Interest Rates address the expense of getting cash, communicated as a level of the chief sum acquired. They are a basic part of financial matters, impacting everything from individual credits to public money related strategy. By and large, when Interest Rates rise, getting costs increment, prompting decreased spending and speculation. On the other hand, lower rates can animate financial development by making advances more reasonable.

The Importance of the 30-Year Fixed Mortgage

The 30-year fixed contract is one of the most well known credit items in the US. It offers borrowers the strength of fixed regularly scheduled installments over a significant stretch, making it simpler to financial plan. As of September 2024, the normal loan cost for a 30-year fixed contract is roughly 7.5%. This rate addresses a critical increment from the verifiable lows seen in earlier years yet stays a well known decision for some homebuyers.

Real-World Example

To show the effect of Interest Rate on contract installments, think about the accompanying situation: a homebuyer buys a $300,000 home with a 30-year fixed contract at a 7.5% financing cost. The regularly scheduled installment would be roughly $2,096, barring local charges and protection. Over the existence of the advance, the complete expense would add up to about $750,000 — almost $450,000 in interest installments alone.

Current Trends in Interest Rates

Recent Changes in Interest Rates

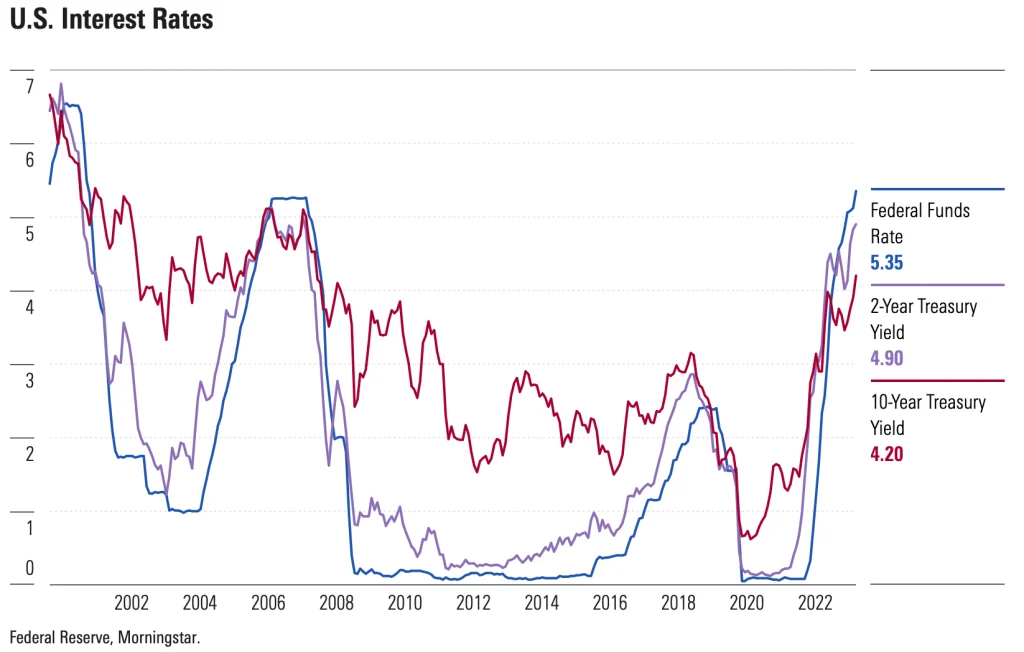

Throughout recent years, loan costs have vacillated altogether. Following the monetary effects of the Coronavirus pandemic, the Central bank carried out strategies to bring down rates, driving home loan costs down to memorable lows. Nonetheless, as the economy recuperated, inflationary constrains provoked the Fed to raise rates, prompting higher getting costs for shoppers.

Interest Rates Chart

A Interest Rates diagram can give significant experiences into verifiable patterns, assisting purchasers with understanding how rates have changed after some time. Numerous monetary sites offer intelligent outlines that show contract rates, permitting clients to see vacillations and pursue informed choices.

Interest Rates in 2024

Looking forward, numerous specialists anticipate that Interest Rate will start dropping in 2024 as expansion balances out and the Central bank changes its financial strategies. Watching out for monetary pointers can assist possible borrowers with expecting ideal circumstances for getting a home loan.

Exploring Interest Rates by Category

Interest Rates BMO

BMO (Bank of Montreal) offers various home loan items and serious rates in the U.S. furthermore, Canada. While contrasting rates, it’s fundamental to survey the loan cost itself as well as any related charges and terms. Utilizing a Interest Rates correlation device can assist you with thinking about BMO’s contributions in contrast to those of different loan specialists, guaranteeing you secure the most ideal arrangement.

Interest Rates Auto Loans

Vehicle credits are another basic region where loan costs assume a critical part. As of September 2024, the normal financing cost for another vehicle credit is roughly 6.2%. Nonetheless, rates can fluctuate in light of elements, for example, your FICO assessment, credit term, and the moneylender you pick.

Real-World Example

For example, on the off chance that you take out a $25,000 vehicle credit with a 6.2% loan fee for quite a long time, your regularly scheduled installment would be about $490, with a complete reimbursement measure of roughly $29,400 — a critical piece being interest.

Interest Rates by Country

Interest Rate are not uniform across the globe; they fluctuate by country due to varying financial circumstances and money related strategies. For instance:

Interest Rates Canada Home loan: In Canada, the typical rate for a 5-year fixed contract is around 5.5% as of September 2024. This mirrors the Bank of Canada’s endeavors to oversee expansion and financial development.

Interest Rates by Country: Nations with solid economies normally have more steady loan fees, while agricultural countries might encounter higher vacillations because of monetary unsteadiness. Looking at rates worldwide can give experiences into what different monetary approaches mean for acquiring costs.

Using an Interest Rates Calculator

A loan costs number cruncher is a valuable device for borrowers. By contributing advance sums, loan fees, and terms, clients can perceive how these variables impact regularly scheduled installments and absolute expenses. This empowers borrowers to try different things with various situations and pursue informed choices in view of their monetary circumstance.

Interest Rates Chart History

Understanding diagram history is fundamental for getting a handle on latest things. By assessing verifiable rates, borrowers can distinguish examples and make forecasts about future developments. Numerous monetary foundations give admittance to these authentic diagrams, permitting clients to dissect information throughout different time periods.

Actionable Tips for Securing the Best Interest Rates

Improve Your Credit Score

One of the best ways of getting a lower financing cost is to further develop your FICO rating. Moneylenders regularly offer better rates to borrowers with higher scores, as this shows a lower chance of default. Straightforward moves toward further develop your financial assessment include:

Covering bills on time

Paying off extraordinary obligation

Staying away from new credit requests prior to applying for advances

Shop Around for Rates

Try not to agree to the top notch you see. Utilize a Interest Rate correlation apparatus to assess offers from numerous loan specialists. Indeed, even a slight distinction in Interest Rates can save you thousands over the existence of your credit.

Consider Shorter Loan Terms

In the event that you can bear the cost of higher regularly scheduled installments, consider selecting a more limited credit term, for example, a 15-year fixed contract. These advances commonly accompany lower Interest Rates and permit you to take care of your home loan quicker.

Lock in Your Rate

At the point when you find a great loan cost, think about securing it with your moneylender. Rate locks ordinarily keep going for a particular period and can safeguard you from potential rate increments while your credit is handled.

Stay Informed

Watch out for monetary markers and Central bank declarations, as these can impact loan costs. Following monetary news and utilizing instruments like Interest Rates number crunchers can assist you with settling on ideal choices.

Conclusion

Understanding loan costs, especially the 30-year fixed contract rate, is critical for exploring the ongoing monetary scene. With rates floating around 7.5% in September 2024, possible homebuyers and those hoping to renegotiate should remain educated and proactive.

Using instruments like Interest Rate number crunchers and graphs, looking at rates across banks, and understanding the more extensive financial setting can engage you to go with informed choices. As we look toward 2024, the chance of dropping rates offers a hint of something better over the horizon for borrowers. By following the noteworthy hints framed in this article, you can situate yourself to get the most ideal loan costs and accomplish your monetary objectives.

ALSO READ MORE: